The Federal Board of Revenue (FBR) has opposed the idea of imposing a sin tax on the tobacco industry. It has contended that the health levy can cause substantial revenue loss worth of Rs. 25 to 30 billion every year.

Meanwhile, the federal government remained unable to take a final decision regarding the sin tax. It decided that the finance and health minister will hold a meeting to discuss the finances for the health sector. Any move regarding this is not anticipated before 2019-20.

“We have taken a clear cut view before the government that there is no need to disturb the existing three-tier tax structure on the tobacco industry at this stage because it will cause substantial revenue loss on account of Federal Excise Duty (FED) and Sales Tax (ST),” says a top FBR official.

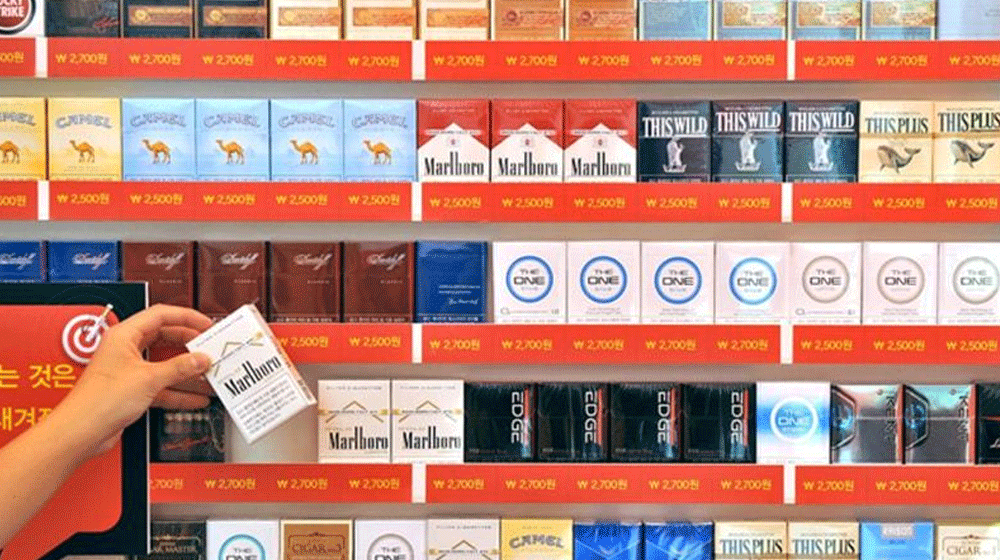

A latest Household Income Expenditure Survey (HIES) has shown that tobacco consumption did not decrease because of the higher tax on cigarettes. Instead, the means of acquiring cigarettes switched from formal to illicit/smuggled.

ALSO READ

Sin Tax to Increase Cigarette Pack Price by Rs.10

FBR maintains that the change in tobacco taxation will give rise to a more complex system. On these grounds, FBR opposed the move to levy a sin tax on tobacco products.

Notably, the debate as to whether or not the taxes on tobacco should increase has persisted since the idea was floated. The main reason for opposition to the increased tax is the prevailing illicit tobacco industry holding a major share in the market.

Tobacco Industry’s Stance

World Health Organization recommends an increase in the tax burden for the tobacco industry to discourage its usage. However, the tobacco industry has argued that the legitimate market keeps a 66 percent share while the illicit share stands at 34 percent, as of March 2018.

They further told the government that the formal tobacco sector is mainly owned by two giant companies that are expected to contribute Rs. 115 billion to the national exchequer in lieu of taxes in the current fiscal year.

Whereas, the illicit tobacco reportedly has a contribution of just 2 percent to the economy, says a study. The study states that “The government is losing Rs. 45 billion due to illicit tobacco.” The price of value for family brands (VFM) stands at Rs. 58 per pack, whereas, the price of a pack coming from the illicit source is Rs. 28.

This huge difference will cause a shift from legitimate/formal to illicit tobacco and the government will suffer a huge loss from it.

And the tobacco lobby wins. Disappointed!